No more waiting for the credit you deserve

Question: What word follows “growth” and “working” to describe two things that business owners need, but struggle to get their hands on? Answer: capital.

100,000 UK firms are refused a bank loan each year. According to the British Business Bank, that’s an approximate £4bn that could be fuelling company growth and benefiting the UK economy.

This is not what businesses deserve.

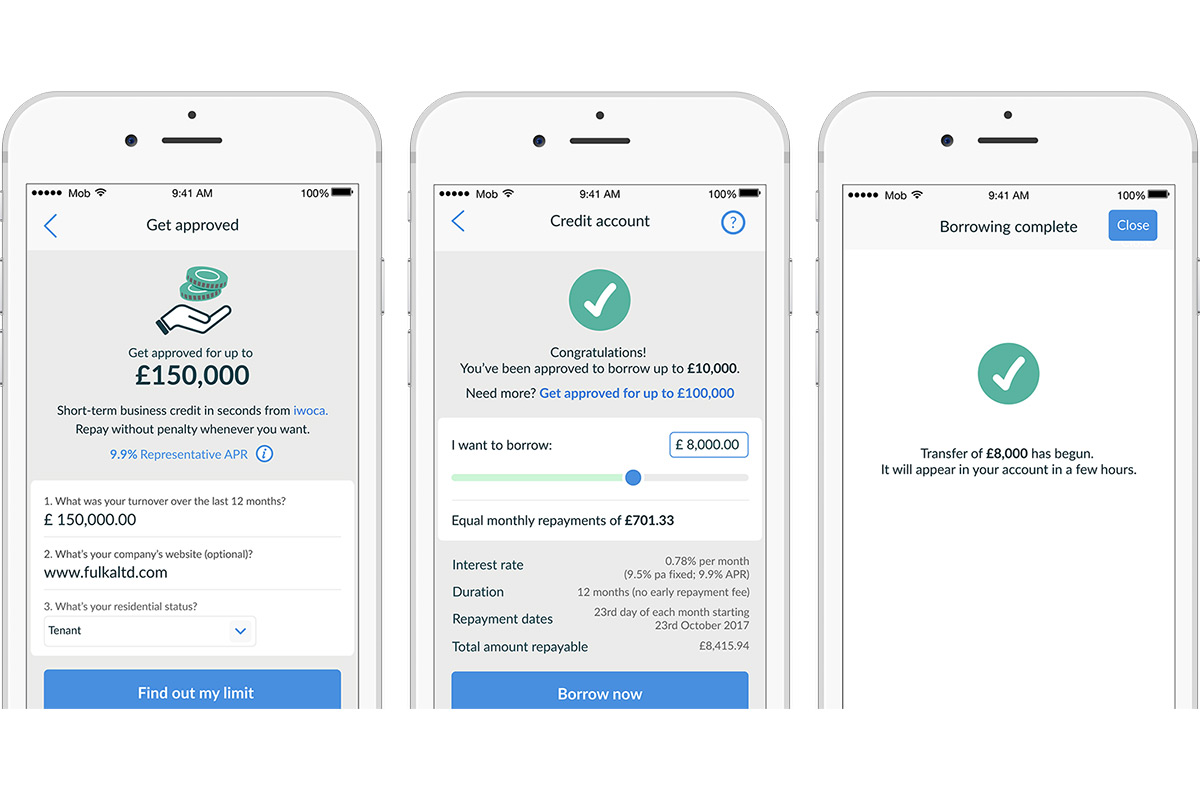

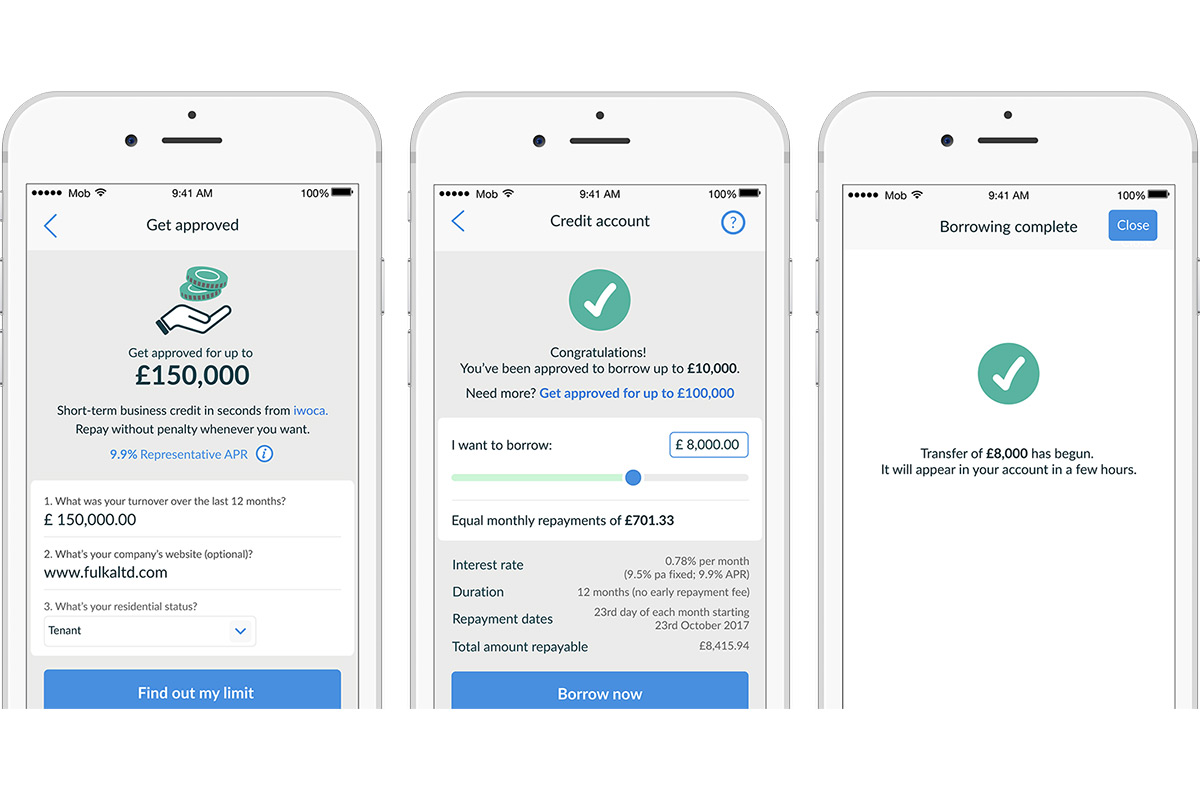

So as of today, Tide is stepping in to offer small and medium-sized companies the debt product they need. We’re rolling Tide Credit out, in partnership with online lender iwoca, to bring fast, fair and flexible funds to our members.

Tide Credit gives you up to £15,000 of capital instantly into your Tide account, after an application and approval process of just two minutes. If you need more than £15,000, just ask – loans of up to £150,000 are available on request.

Speed isn’t the only thing that sets Tide Credit apart from other loan products. Members can make unlimited early repayments without penalties. We don’t think it’s fair that you should pay more if you want to pay sooner! Our representative APR, with specific rates that reflect borrower circumstances, stands at a competitive 9.9%.

Tide Credit is starting to roll out on Android devices from today, and we’re launching on iOS in the coming weeks.

So there’s help on hand if you’re in the middle of a cashflow crunch. We’re by your side when you need to invest in the latest equipment for your business.

And best of all, we help you get through it quickly. So you can get back to doing what you love.